-

회사소개

-

제품과 솔루션

-

제품과 솔루션

-

석고보드

-

석고보드

- 시트락 일반석고보드

Technical Boards

- 일반석고보드

Technical Boards

- 차음석고보드

Technical Boards

- 방화석고보드

Technical Boards

- 방수석고보드

Technical Boards

- 방화방수석고보드

Technical Boards

- 방균석고보드

Technical Boards

- 우드32

Technical Boards

- 아트사운드

Technical Boards

-

-

천장재

-

천장재

- 시트락 집텍스

Technical Boards

- 집텍스 에코

Technical Boards

- 집톤

Technical Boards

- 엑시톤&엑시텍스

Technical Boards

- 임프레션 클리마플러스

Technical Boards

- 레이더 클리마플러스

Technical Boards

- 올림피아 클리마플러스

Technical Boards

-

-

컴파운드

-

컴파운드

- 시트락 올퍼티 에코

Technical Boards

- 올퍼티

Technical Boards

- 줄퍼티 플러스

Technical Boards

- 줄퍼티 세이빙

Technical Boards

- 집본드

Technical Boards

-

-

고성능 차음 스터드

-

고성능 차음 스터드

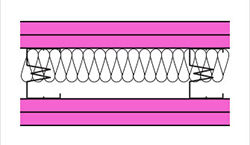

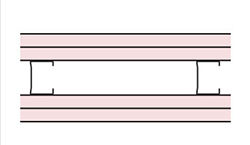

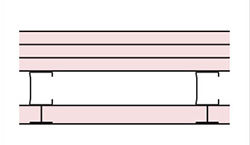

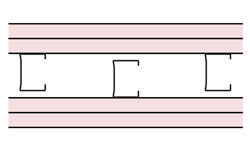

- W-스터드

Technical Boards

-

-

액세서리

-

액세서리

- 와이어식 비상 탈출구 시스템

Technical Boards

- V-BRACE

Technical Boards

-

- 단열재

-

USG 제품군

-

USG 제품군

- 파이버락

Technical Boards

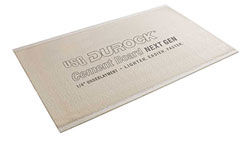

- 듀락 시멘트 보드

Technical Boards

- 시큐락 지붕 석고보드

Technical Boards

-

-

-

기술자료

-

기술자료

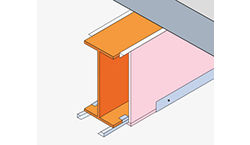

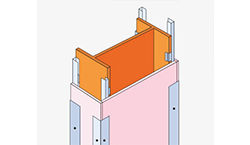

- 내화차음칸막이 시스템

- 내화칸막이 시스템

- 인케이스먼트 시스템

-

시험성적서/인증서/MSDS

-

시험성적서/인증서/MSDS

- 시스템 인정서

- 제품 인증서

- 시험 성적서

- MSDS 물질안전보건자료

-

-

시스템 인정서

-

시스템 인정서

-

-

시험 성적서

-

시험 성적서

-

-

제품 인증서

-

제품 인증서

-

-

MSDS 물질안전보건자료

-

MSDS 물질안전보건자료

-

-

열관류율 계산툴

-

열관류율 계산툴

-

-

제품 인증서

-

제품 인증서

-

-

- 고객지원

-

자료검색

-

자료검색

- 자료검색

- 최신뉴스

Boral sees huge growth potential in Korean market

Boral, a leading Australian building materials maker, sees huge potential in the Korean market as demand for remodeling of buildings and apartments grows.

< 아트사운드를 컨벤션센터 내 대회의실 천장에 시공한 모습 >• Boral, a leading Australian building materials maker, sees huge potential in the Korean market as demand for remodeling of buildings and apartments grows. Boral CEO Mike Kane said Korea was one of the four most important markets for the company, along with Australia, Thailand and Indonesia. "Korea and Australia lead the way in terms of business size and scope in developed markets," Kane said in an interview with The Korea Times. "We look to Korea to help us bring operations around Asia up to the standards of Korea." The company, which mainly produces plasterboard, started business here in 1998 and has been expanding market share. Kane, who chose Korea as the first destination for his Asia trip, said that the most interesting part of the Korean market was the remodeling boom. "A lot of repair and remodeling work is done in shops that are converting to different formats and different looks in a commercial setting, as well as homes and condominiums," Kane said. "They need plasterboard products to help in that work. That is a significant part of the most mature market. It is why there is continued growth inside the portfolio in matured markets." In 2002, when local companies were moving their bases to China to find cheap labor, Boral closed one of its China factories and opened one in Dangjin. USG Boral, after a merger with US building material firm USG in 2014, now has 45 percent of the domestic market in terms of manufacturing share, rivaling local building material giant KCC. The firm supplies plasterboards, ceiling tiles and compounds to other construction firms as well, including Byucksan. Annual sales nearly doubled to 220 billion won in 2013, from 132 billion won in 2001. The company made more than 250 billion won last year, posting a record 13 percent growth. The company said the growth stemmed from its innovative products. Kane said trends showed a move to lightweight materials that were easier to install and more durable. The company this year launched Sheetrock, a product that is 10 percent lighter than the company's former model. It said the initial response from Korean buyers had been good. "We are focused on how we can minimize the number of application points in this market to cut costs," Kane said. "Cost becomes the driving factor in matured markets like Korea. "We think Asia is the big opportunity for next 50 years. We look to Korea as the example of how it is done in the Asian context."

공유하기

-